where to get ifta stickers in louisiana

For buses please place one sticker on each side no further back than the back of the drivers seat at eye level from the ground. If you do not display the identification stickers in the mandatory placement sites you may account for a fine or penalty if you do not carry a copy of your.

Louisiana La Ifta State Tax Ifta Quarterly Fuel Tax Ifta Online

State Requirements Louisiana IFTA Licensing.

. Carriers are encouraged to call. Also some states allow exceptions for specific types of fuel where you. IFTA short for the International Fuel Tax Agreement is an agreement among US states and Canadian provinces to make it easier for Interstate carriers to report and pay taxes on the motor fuels they use. It will contain every up-to-date form application schedule and document you need in the city of Shreveport the county of Bossier and the state of Louisiana.

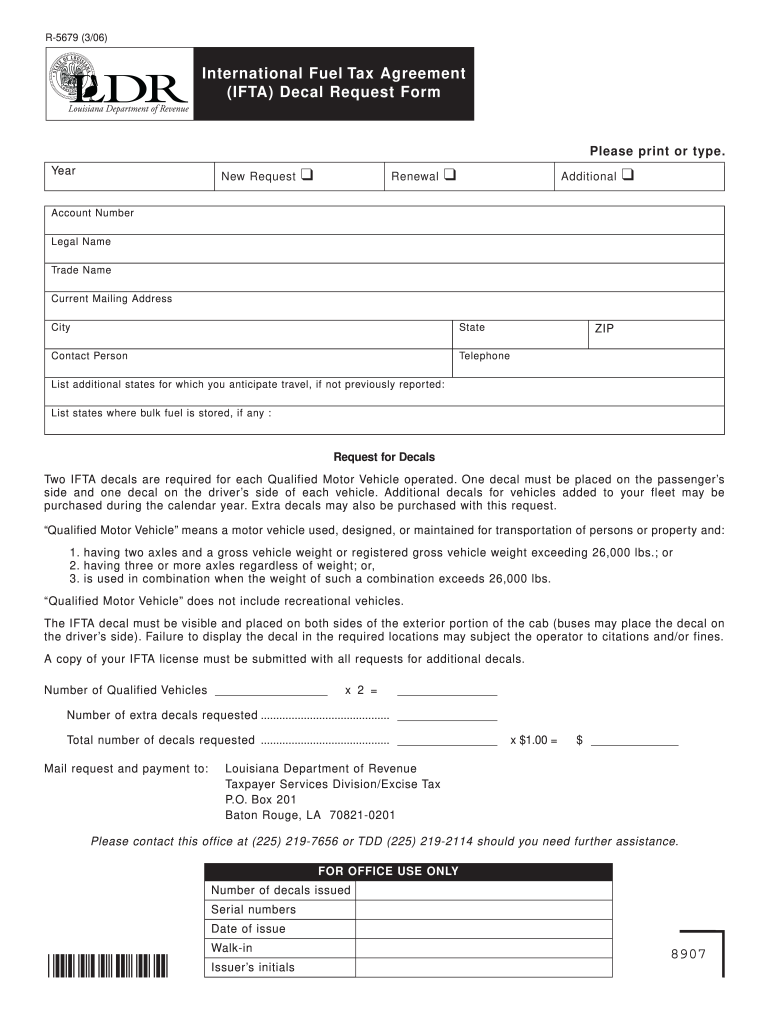

Decals are valid from January 1 to December 31 per year. Failure to file a return filing a late return or failure to remit any or all tax due will result in a penalty of 5000 or 10 of the net tax due to all member jurisdictions whichever is great. Once you have completed all necessary tax requirements and have received your Letter of Good Standing you may send a copy of that letter with your IFTA Application for new carriers or your IFTA Renewal Application to the DMVIRP Office at the address listed on the form to obtain your IFTA license and credentials. Each qualified vehicle is required to post 1 decal on each side of the vehicle.

When filing your quarterly fuel use tax reports you can find the Alabama IFTA Fuel Tax Form here. If you operate in at least two or more member states or provinces you can register and take advantage of. You must obtain IFTA decals 2. Page 43 of 48.

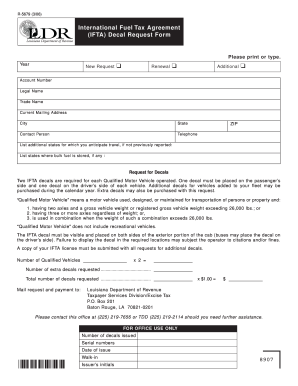

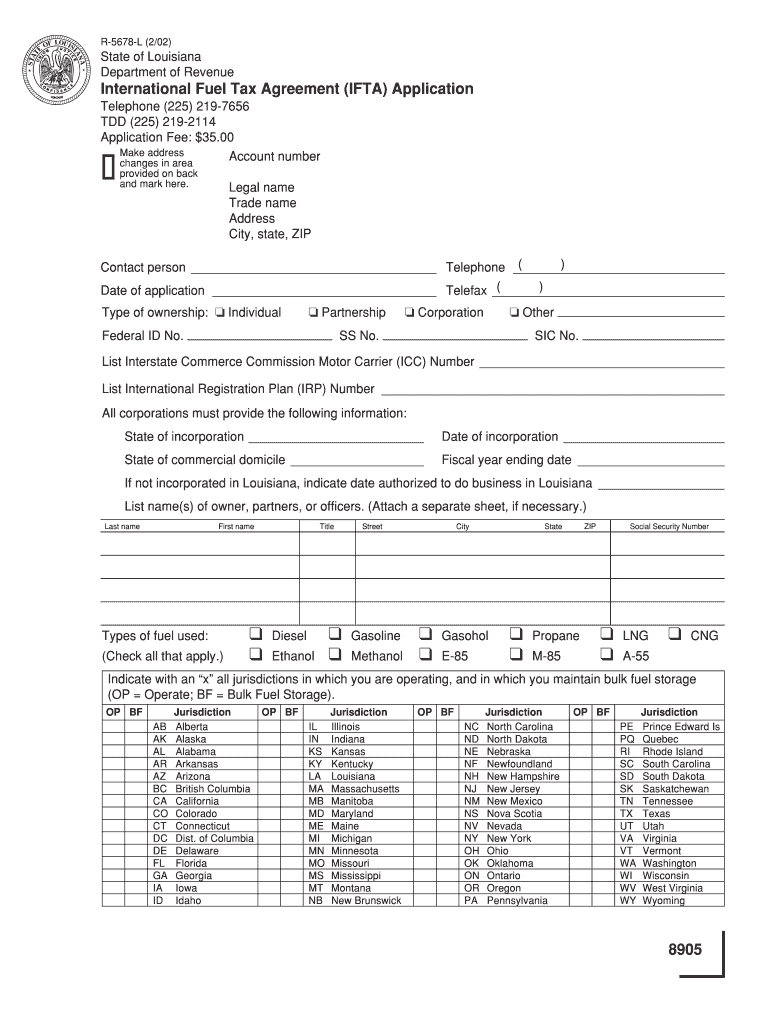

The easiest way to get IFTA stickers or a license is to call our organization. International Fuel Tax Agreement IFTA Decal Request Form 8907 R-5679 306. Tracking and reporting is made considerably more. Louisiana is your base jurisdiction if you meet the following IFTA requirements.

You must attach one sticker to each side of the vehicles rear in the lower corner. Louisiana IFTA Refunds and Credits. REV-1026 -- Information Concerning Motor Carriers Road Tax and International Fuel Tax Agreement. You must then track your mileage in each state or province and keep track of your fuel usage in each.

You must apply for one IFTA license for your entire fleet. In person at a field office. Failure to display decal or copy of the IFTA license may result in the vehicle. You must attach one decal to each side of the vehicles cab in the lower rear corner.

In addition to your license the Fuel Tax Unit will issue you a set of calendar-year decals for each qualified vehicle in your fleet based on the number of qualified vehicles listed on your application. However while every effort is made to provide same day service this is not always possible if the number of visitors is high or the carrier is not properly prepared. The IFTA makes it easy for ownersoperators to file their taxes via multiple states. Assuming that you meet the standards for IFTA you will be issued with the correct license and decals.

Louisiana Trip Permit. If youre wondering about exemptions youll find that there are several jurisdictions that are considered non-IFTA miles. If you own andor operate a commercial truck or fleet that meet IFTA qualifications you will need an IFTA license and decals to display on each vehicle. Ordering and Paying for IFTA Decals.

REV-1026A -- Information Concerning Motor Carriers Road Tax - For Carriers Operating Only in Pennsylvania. Our experts can take care of all paperwork on your behalf. You will need one set of decals per qualified vehicle. The applicant is required to make copies of the IFTA license so that one copy can be carried in each qualified motor vehicle.

A vehicle will not be considered operating under IFTA unless there is a copy of the license in the vehicle. Decals should be received within 7-10 business days. Credits with amounts greater than. How do I obtain a Louisiana IFTA return.

When the need arises the Bureau of Commercial Vehicle and Driver Services BCVDS Walk-In Service Center in Tallahassee Florida is available to process IFTA forms and payments as well as issue licenses and decals. Vehicles which are registered in another state can operate on LA highways by either obtaining credentials from their state which indicate the vehicle has paid appropriate fees for the State of Louisiana or by obtaining a temporary permit which allows them to operate on Louisiana highways for forty. Box 201 Baton Rouge LA 70821-0201 Please contact this office at 225 219-7656 or TDD 225 219-2114 should you need further assistance. Prepared International Fuel Tax Agreement IFTA Decal Request Form.

Registering for LDR Business Account. Plus theyll communicate with the FMCSA and DOT until you receive your stickers. Where can I get more information on Louisianas IFTA conditions and regulations. Review current requirements and restrictions on the IFTA.

New Louisiana IFTA Fuel Tax Accounts You will need to submit a Louisiana application online or in person. Tom Wolf Governor C. Mail request and payment to. Once complete you should return it to the regulating body with the requested processing fee.

Obtain your IFTA licenses and decals. You must file an IFTA Decal Application annually to order a set of 2 decals for each qualified vehicle 10 a set. You are now registered to take part in the IFTA program. We recommend that you obtain a Business License Compliance Package BLCP.

You should speak to the motor carrier vehicle section of that jurisdiction and ask to obtain an IFTA license and decals to present on your auto. Filing Initial IFTA Registraton. IFTA-300 -- Individual Vehicle Mileage Records. Louisiana is located in Southern United States and is known as The Creole State with a population of about 46 million people.

Or your IFTA license Otherwise written below is a common method for getting a license and stickers. Same day decals are available when you apply in person. The IFTA license is valid for the current calendar year and expires December 31st. Interest is computed on all delinquent taxes dues each jurisdiction at a rate of 04167 per month.

Your Louisiana Quarterly IFTA Return can be completed and generated with ease at ExpressIFTA. Please print or type. IFTA-200W -- IFTA Decal Waiver. They are obtained through your state or provincial agency.

Louisiana Department of Revenue Taxpayer Services DivisionExcise Tax PO. In Louisiana you can request an IFTA license online from the Department of Revenue. Where Do I Place My IFTA Sticker. There is a 35 application fee and 2 per set of decals fee.

By mail print the IFTA Application and IFTA Decal Application. Louisiana Trip And Fuel Permit - IRP and IFTA permits for Louisiana. IFTA-200S -- Application for Additional Motor Carrier Road TaxIFTA Decals. To get your IFTA stickers and IFTA permit you must submit an Alabama IFTA License Application MV.

Decal Request Fill Out And Sign Printable Pdf Template Signnow

Ifta Registration Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Ifta Fuel Tax Requirements

Louisiana Ifta Decals On The Go

Ifta Louisiana Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "where to get ifta stickers in louisiana"